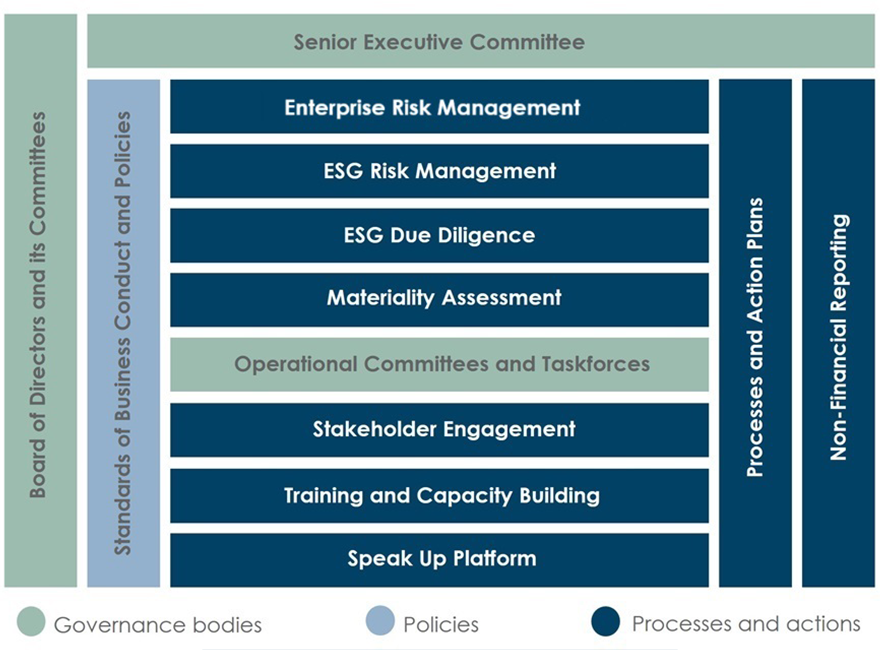

Policies

The Group’s Standards of Business Conduct approved by the Governance and Sustainability Committee of the Board guide legal, ethical and sustainable decisions in all countries where the Group operates. The Standards have been developed with consideration of emerging regulations and are reviewed regularly.

Building on the Standards of Business Conduct, Richemont’s Supplier Code of Conduct, the Environmental Code of Conduct and the Human Rights Statement support the ESG Management System. The Supplier Code of Conduct was updated in FY25 focusing on environmental and social standards throughout the Group’s supply chains.

ESG Risk Management

Richemont’s ESG Management System encompasses a risk management framework that supports regulatory compliance and drives sustainability actions. The ESG risk management process has been further enhanced this year and involves several key steps.

First, a catalogue of ESG-related negative and positive impacts, along with financial risks and opportunities, is identified. Climate-related risks are then categorised using the Task Force on Climate-related Financial Disclosures (TCFD) framework. This catalogue is used as a starting point for the Materiality Assessment. Next, these identified impacts, risks, and opportunities are prioritised through a systematic calculation logic based on interview scoring and a weighting mechanism. Finally, the prioritised impacts, risks and opportunities are assessed to understand their effects, underlying drivers, current mitigation efforts, and potential action plans, using internal and external data sources, including scenario analysis for climate-related risks.

Training and Capacity Building

Building internal knowledge and capacity on sustainability allows the Group to respond effectively to the constantly changing marketplace and regulatory environment.

In FY24, the Richemont Sustainability Academy online platform was launched, a Group-wide training programme offering a suite of courses and modules. The goal of the Academy is to equip everyone within the Group with the right training opportunities.

Materiality Assessment

The Materiality Assessment is the cornerstone of the Group’s non-financial reporting. The Group is moving towards a Double Materiality Assessment principle, by which its actual or potential, positive or negative impacts on people and the environment, and the effect of risks and opportunities on its financial position are assessed in parallel.

The FY25 Materiality Assessment builds on the results of previous assessments, including the Group’s FY23 Materiality Assessment which leveraged extensive external stakeholder engagement.

Our Approach

Environment

Richemont continuously endeavours to manage and reduce its environmental impacts across its operations and supply chains.

Social

Richemont supports its people throughout the employment journey and has been recognised as an attractive place to work.

Supply chain

Richemont encourages responsible conduct within its supply chains and is continuously enhancing its management systems.

Governance

Richemont embeds sustainability at the highest governance level of the Group through the Governance and Sustainability Committee.